nd sales tax calculator

Sales Tax Table For Fairfield North Dakota. Local tax rates in North Dakota range from 0 to 35 making the sales tax range in North Dakota.

State Corporate Income Tax Rates And Brackets Tax Foundation

Fill out the sales and use tax application.

. You can now choose the number of locations within North Dakota. So whilst the Sales Tax. How much is sales tax in North Dakota.

North Dakota Vehicle Registration Tax LoginAsk is here to help you access North Dakota Vehicle Registration Tax quickly and handle each specific case you encounter. S North Dakota State Sales Tax Rate 5 c County Sales Tax Rate. Discover Helpful Information And Resources On Taxes From AARP.

Avalara provides supported pre-built integration. Look up 2021 North Dakota sales tax rates in an easy to navigate table listed by county and city. Ad Manage sales tax calculations and exemption compliance without leaving your ERP.

Free sales tax calculator tool to. Tax Commissioner Brian Kroshus announced today that North Dakotas taxable sales and purchases for the first quarter of 2022 are up. Thursday June 23 2022 - 0900 am.

L Local Sales Tax Rate. 54 rows A sales tax is a consumption tax paid to a government on the sale of certain goods and services. The base state sales tax rate in North Dakota is 5.

If you have tax rate as a percentage divide that number by 100 to get tax rate as a decimal. To find the total sales tax rate combine the North Dakota state sales tax rate of 5 and look up the local sales tax rate with TaxJars Sales Tax Calculator. The base state sales tax rate in North Dakota is 5.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. Go to the North Dakota business portal. Sales Tax Rate s c l sr.

North Dakota has a 5 statewide sales tax rate but. A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the. RE trans fee on median.

The North Dakota sales tax rate is 5. Below is a table of common values that can be used as a quick lookup tool for an average sales tax rate of 5 in Fairfield North Dakota. Multiply the price of your item or service by the tax rate.

Sr Special Sales Tax Rate. Usually the vendor collects the sales tax from the consumer as the consumer makes. Your household income location filing status and number of personal.

The latest sales tax rates for cities in North Dakota ND state. Real property tax on median home. 2020 rates included for use while preparing your income tax deduction.

2022 North Dakota Sales Tax Table. Depending on local municipalities the total tax rate can be as high as 85. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes.

Local tax rates in North Dakota range from 0 to 35 making the sales tax range in North Dakota 5 to 85. The North Dakota ND state sales tax rate is currently 5. How to Calculate Sales Tax.

Steps 1 to 3 will allow you to calculate Sales Tax on the net or gross sales cost of goods andor services for the area chosen. To calculate registration fees online you must have the following information for your vehicle. Before Tax Amount 000.

Free sales tax calculator tool to estimate total amounts. North Dakota Sales Tax Calculator and Economy. North Dakota Title Number.

Ad Manage sales tax calculations and exemption compliance without leaving your ERP. Exemptions to the North Dakota sales tax will vary. There is no fee to obtain a sales tax license in North Dakota.

Rates include state county and city taxes. North Dakota sales tax is comprised of 2 parts. State Sales Tax The North Dakota sales tax rate is 5 for most retail.

Or the following vehicle information. Avalara provides supported pre-built integration. The sales tax is paid by the purchaser and collected by the seller.

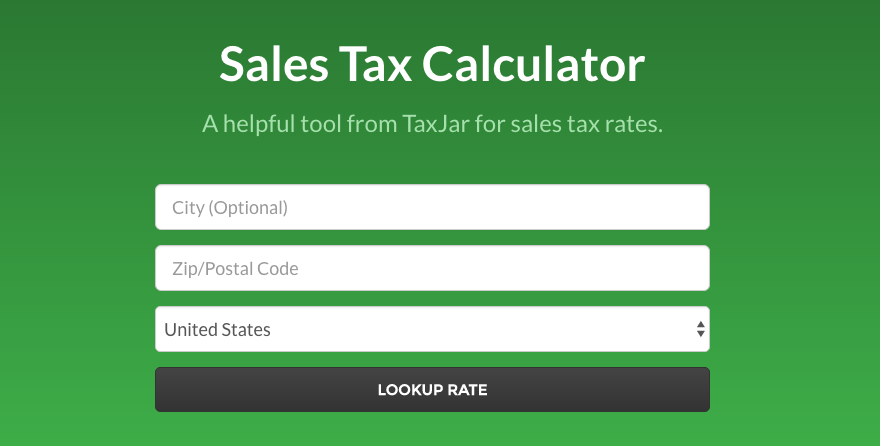

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. North Dakota assesses local tax at the city and county. Just enter the five-digit zip.

The North Dakota sales tax rate is 5 as of 2022 with some cities and counties adding a local sales tax on top of the ND state sales tax. Sales Tax State Local Sales Tax on Food. Use our Sales Tax Calculator to.

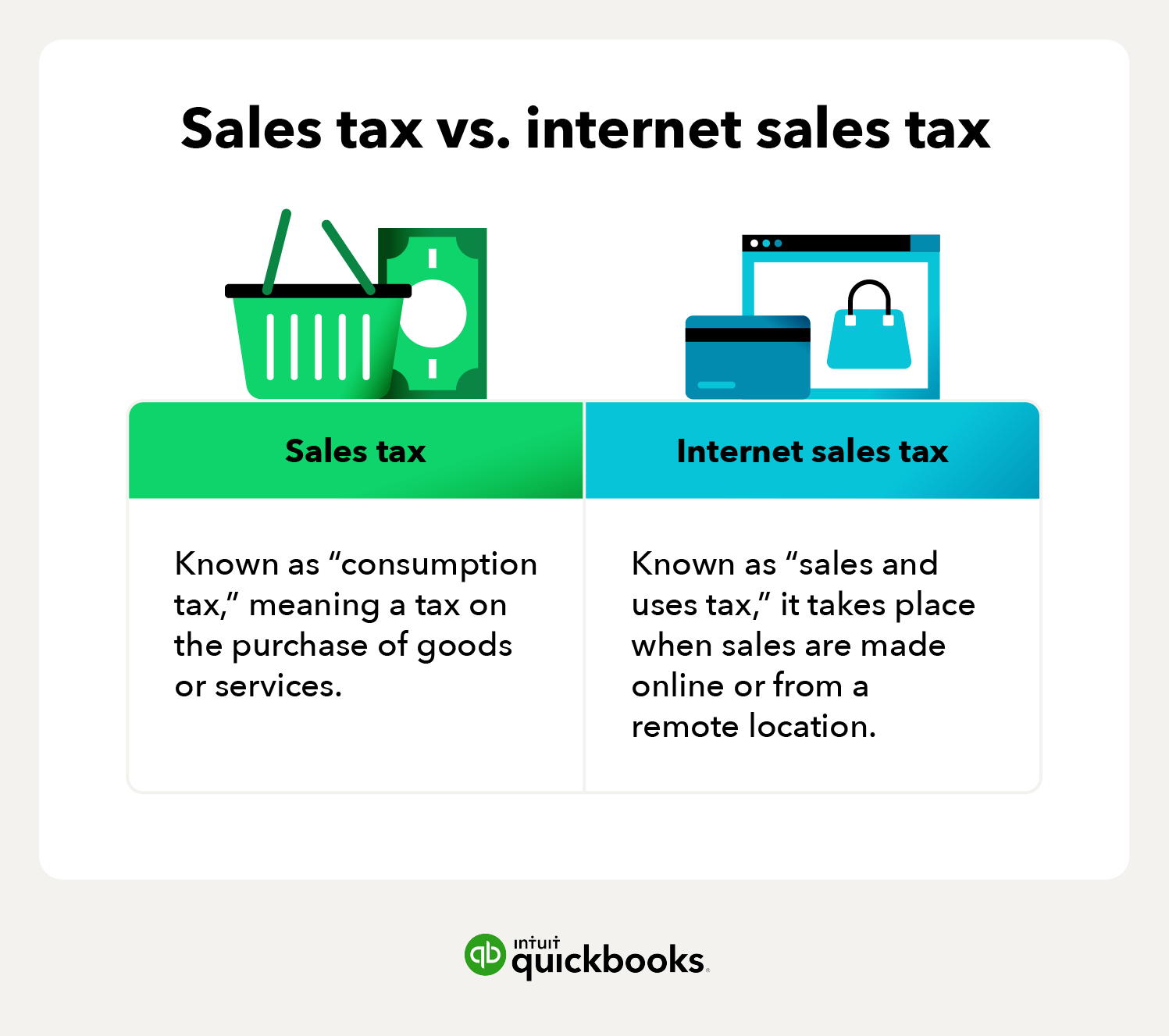

What Is Sales Tax A Complete Guide Taxjar

Free Business Sales Tax Calculator Calculate Your Tax Now With Clickfunnels

Internet Sales Tax Definition Types And Examples Article

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

North Dakota Tax Rates Rankings Nd State Taxes Tax Foundation

Internet Sales Tax Definition Types And Examples Article

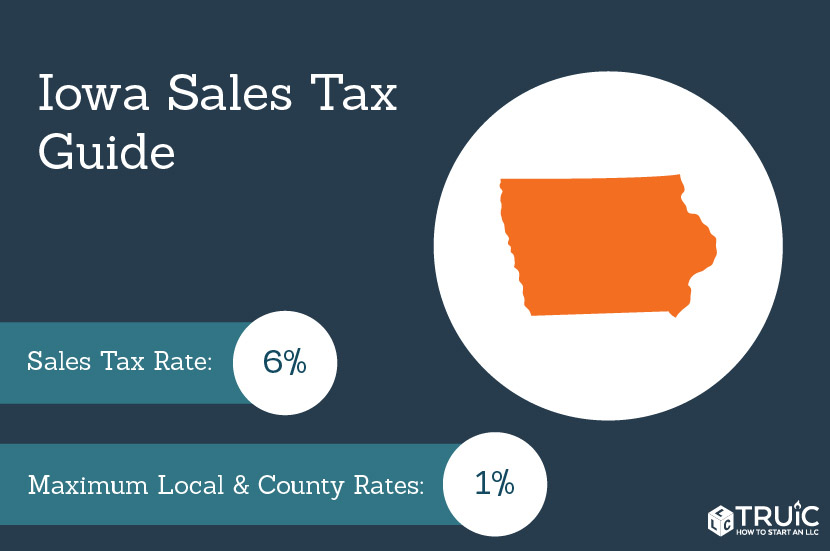

Iowa Sales Tax Small Business Guide Truic

North Dakota Sales Tax Rates By City County 2022

The Consumer S Guide To Sales Tax Taxjar Developers

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

State Corporate Income Tax Rates And Brackets Tax Foundation

Sales Tax Calculator Check Your State Sales Tax Rate